what is a closed tax lot report

Not sure if that matters but thought of mentioning it. What information can I view on closed lots.

Non Profit Treasurer Report Template

On the Tax Information page select the button next to View Closed Tax Lots then select View Tax Information.

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

. Tax lot ID methods we support. Short- or long-term. Short- or long-term status of the sale.

Gain or loss amount. Make a list of questions you have about cost basis reporting. Using the FIFO method you have a realized gain of 650 excluding commissions and fees.

A tax-lot relief method is used to determine which lots of a security are liquidated first in a given sales transaction. What Are Tax Lots. Under a noncovered tax lot select Edit Tax Lot.

A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares A tax lot identification method is the way we determine which tax lots are to be sold when you have a position consisting of multiple purchases made on different dates at differing prices and you enter a trade to sell only part. With closed tax lots you can track the following information for each security you currently own. A lot or parcel created solely by a tax lot segregation because of an assessors roll change or for the convenience of the assessor.

500 will be taxed at long-term rates of 0 to 15 percent and. Tax paid in full or agreement made to satisfy a balance due. Discuss tax lot relief methods and your tax lot relief strategy with your advisors.

It is probably the most common and straightforward tax lot ID method. View the latest report View past reports. Gain or loss amount.

The ability to apply tax management strategies on an account-wide basis will allow you to more efficiently tax manage portfolios. Free tax assistance for those with limited income and those over 60. 100 shares X 5 50 shares X 7 500 350 850 cost basis.

For example lets assume that you purchase 50. The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position. Why not Banksy or Andy Warhol.

A lot or parcel created by an intervening section or township line or right of way. As Wells Fargo Advisors is not a legal or tax advisor we encourage you to speak to your chosen tax. In turn it helps identify the cost basis and holding period of the asset sold.

For example assume an investor purchased 100 shares of Netflix in March 2017 for. Every time you sell shares a closed tax lot is created to track the date and price of your sale. What is the benefit of relieving tax lots at the account level.

These lots record data important to the determination of capital gains taxes including. Every time you sell shares a closed tax lot is created to track the date and price of your sale. You own shares of Apple Amazon Tesla.

Your capital gain or loss is equal to the difference between the assets cost basis and the sales price of the closing transaction. In the menu located next to the account select Tax Information. How Does Tax Lot Accounting Work.

Tax lot accounting is primarily the record-keeping of tax lots. What is a closed tax lot Report. Tax lots are records of data pertaining to your acquisition of securities like stock bonds and options.

The Closed Lots view provides cost basis and gainloss information for all lots that were closed in the position. Their works value doesnt rise and fall with the stock market. Choose the time period and either Realized or Unrealized gain and loss information then select View Gains.

Tax lot accounting is the record of tax lots. Tax lot accounting is a method of record keeping that tracks the cost purchase date and sale date for every unit of every security in a portfolio. Input the Purchase Date Number of Shares and Total Purchase Cost and then select the.

FIFO first-in first-out LIFO last-in first-out Highest cost Lowest cost Specific lot Tax efficient loss harvester Average cost First-in first-out FIFO selects the earliest acquired securities as the lot sold or closed. When securities are sold the. Get free tax assistance.

Go to your Accounts page. Annual Report to Congress. If you sell all 100 shares from Lot A and 50 shares from Lot B FIFO.

User ID Password Log In. To edit your tax lot. The tax rate on long-term capital gains tops out at 20 for single filers who report over 445850 or more in income in 2021.

If available gainloss information is provided for closed lots that require 1099-B reporting. 150 shares X 10 1500 - 850 650 Total Gains. A lot or parcel created by an unrecorded subdivision unless the lot or parcel was conveyed pursuant to subsection A3.

A tax lot is a record of the date quantity and cost of a purchase or opening transaction short sale. Jean purchases a vacant lot for 10000. Absent a specific instruction from you by the settlement date of the sale to utilize a different tax lot ID method we are required by the tax law to apply FIFO.

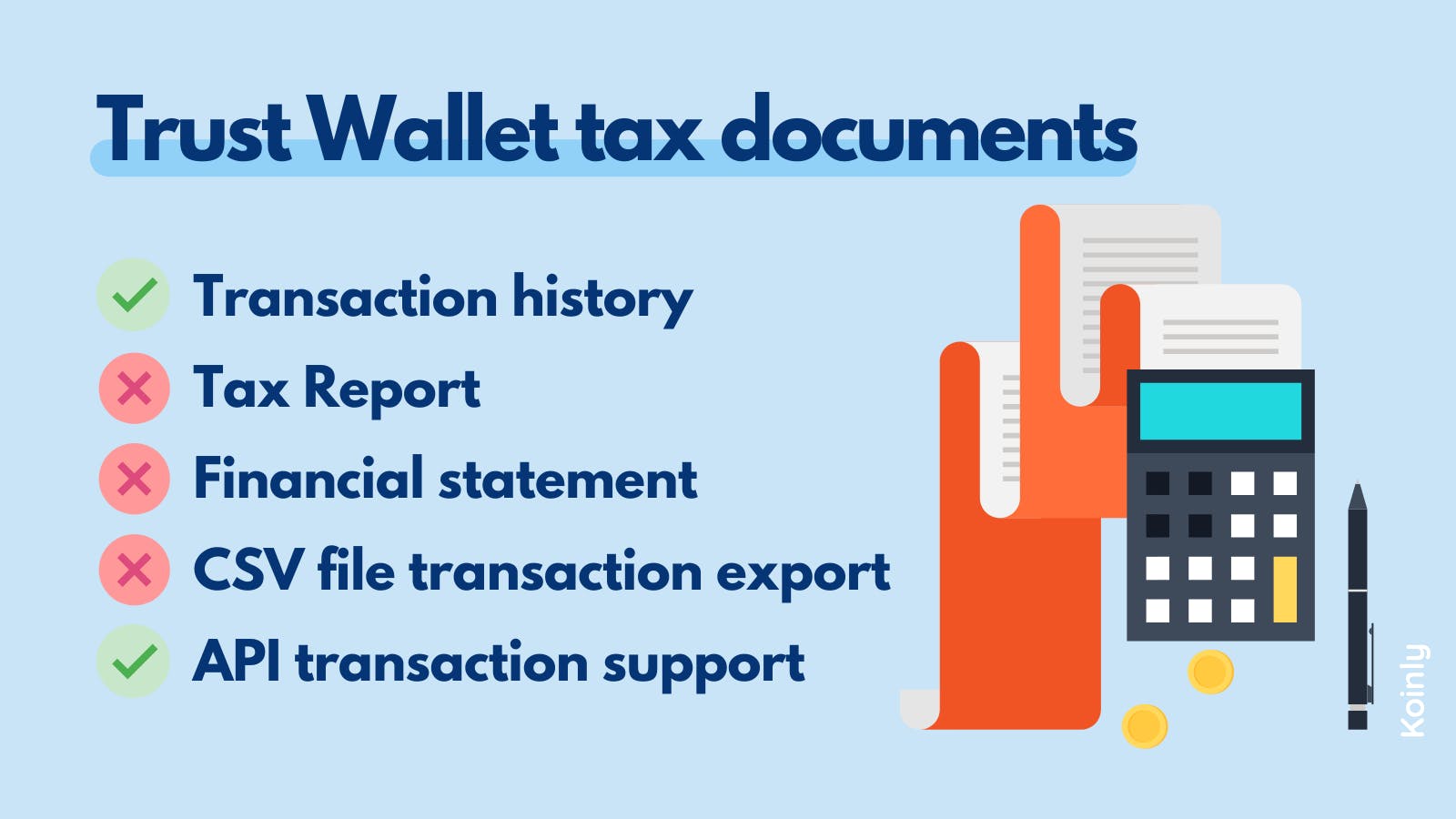

How To Do Your Trust Wallet Taxes Koinly

Introducing Ihomereport Investing Real Estate Tips How To Know

How To Do Your Trust Wallet Taxes Koinly

Image Result For Tax Client Interview Form Card Template Templates Excel Templates

10 Things To Consider When Choosing An Accounting Firms In Dubai Uae Accounting Firms Profit And Loss Statement Accounting Services

Accounting Equation Chart Cheat Sheet In 2022 Accounting Payroll Accounting Accounting Notes

:max_bytes(150000):strip_icc()/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

4 Steps To View The Shopify Finances Summary Page On Shopify Avada Commerce Finance Financial Dashboard Sales Dashboard

Minimum Wage Would Be 61 75 If It Grew Like Wall Street Bonuses Report In 2022 Minimum Wage Wall Street Marketing Jobs

Fitbit Sent 4 23 13 Your Weekly Progress Report In Fitbit Through Their Wireless Trackers Scales And Mobile Tools Fitbit Collects A Lot Of Informati

5 Investment Tax Mistakes To Avoid Tax Mistakes Investing Tax Preparation

Definition What Is A Tax Return Tax Return Tax Preparation Tax Preparation Services

/1099B2022-95af0a55817a4b8ea69f159a8c8451c1.jpg)

Form 1099 B Proceeds From Broker And Barter Exchange Definition

7 Things About Capital Gains In 2021 Real Estate Investor Capital Gains Tax Capital Gain

Rental Security Deposit Refund Form

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

Form 1099 Int Interest Income Definition

Tax Time Word Search Puzzle Word Search Puzzle Free Word Search Puzzles Tax Time

What Is An Expense Report And Why They Re Important For Small Businesses