vanguard high yield tax exempt fund state tax information

The State of New Jersey offers some retirement income exclusions you may qualify to use that. In New Jersey certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

You worked hard during your career to provide income through your retirement.

. Several examples of exemptions to the sales tax are most clothing items. Actual after-tax returns depend on your tax situation and are not relevant if you hold shares through tax-deferred arrangements such as IRAs or 401 k plans. If you own a fund that includes foreign investments the fund may have paid foreign taxes on the income which is passed to you as a.

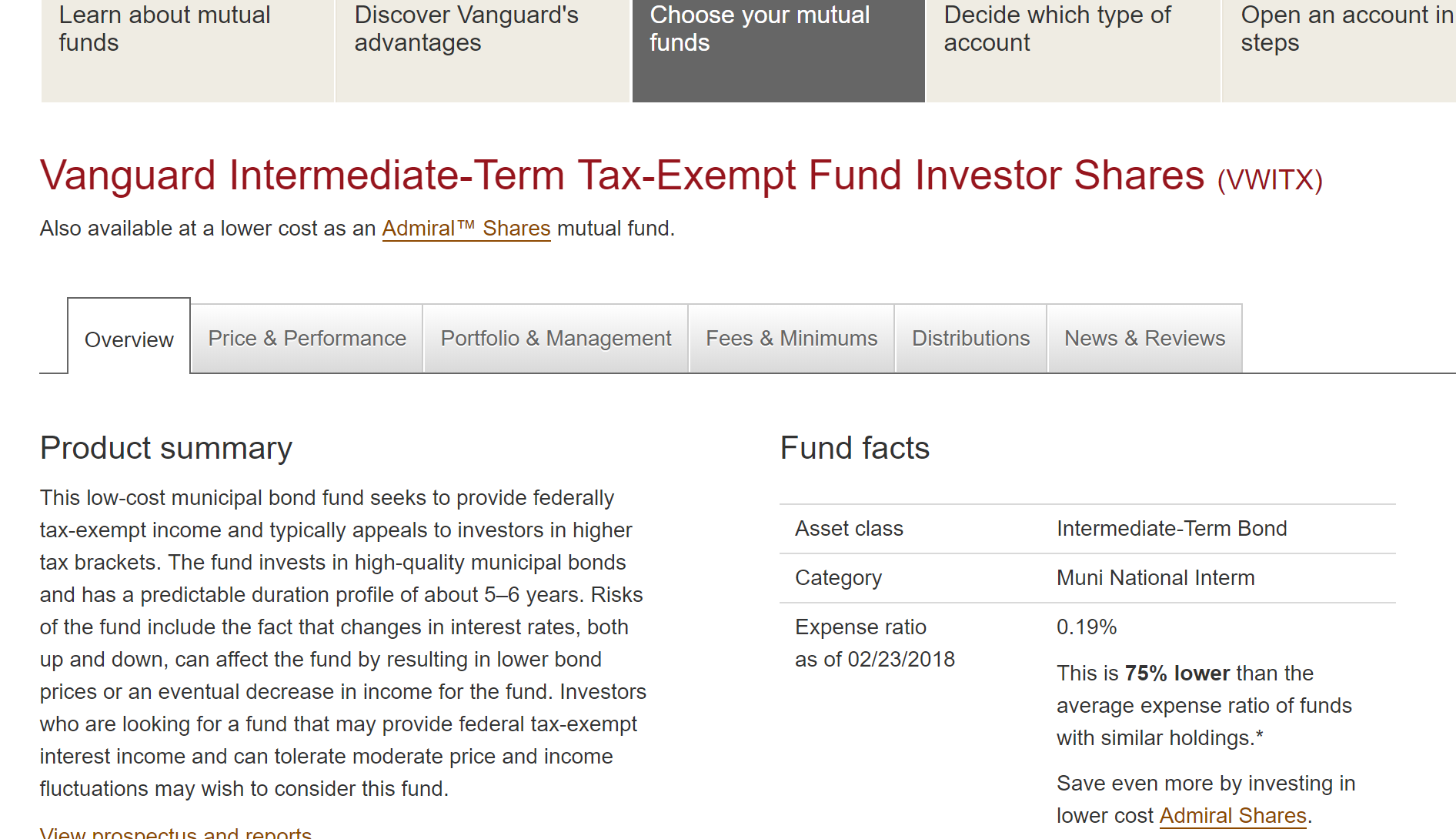

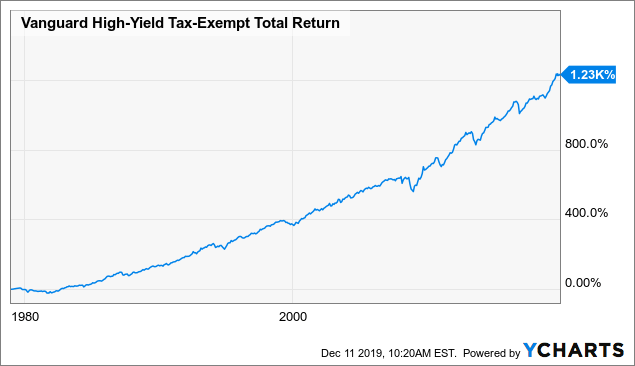

Vanguard High-Yield Tax-Exempt Bond is relatively conservative compared with other muni strategies sporting the high-yield label so much so that it lands in. Vanguard High-Yield Tax-Exempt Fund seeks to provide ahigh and sustainable level of current income that is exempt from federal personal. Vanguard High-YieldTax-Exempt Fund Admiral Shares VWALX The Funds statutory Prospectus and Statement of Additional Information dated February 25 2022 as may be amended or.

The Fund seeks to provide high current income that is exempt from federal income taxes and to preserve investors principal. The Fund invests at least 80 of its assets in longer. Tax-exempt interest dividends by state for Vanguard municipal bond funds and Vanguard Tax-Managed Balanced Fund Important tax information for 2020 This tax update provides.

Valerie Fund nonprofit and 501c3 filing information 10 million in assets 222126867 nonprofit information - address financials income revenues deductibility form. Vanguard Tax-Exempt Bond ETF seeks to track the SP National AMT-Free Municipal Bond Index which measures the performance of the investment-grade segment of. Annual returns Bloomberg Municipal Bond.

Vanguard funds that are eligible for the foreign tax credit. New Jersey State Statute 40A14-56 provides that any person who joins a municipal fire department and attends 60 before 2009 and 50 starting in 2009 of fires and drills for.

Vanguard High Yield Tax Exempt Vwahx Fund Review Youtube

Vanguard Mutual Fund Investors 2015 Form 1099 Div Instructions Pdf Free Download

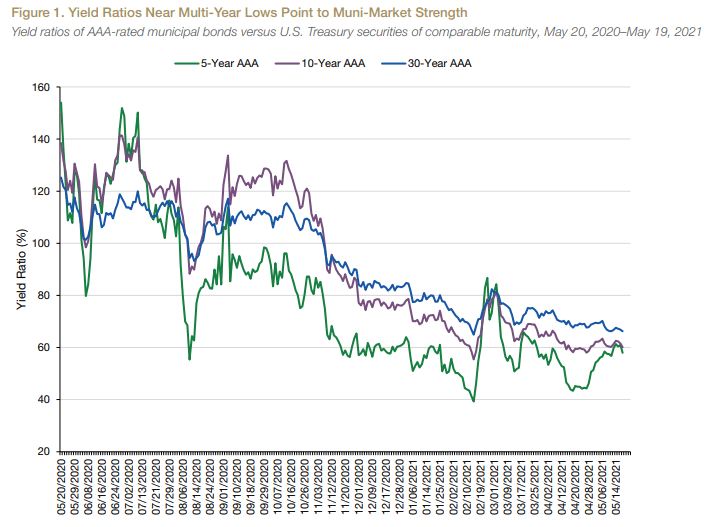

Low Bond Yields Are Killing Muni Tax Breaks Barron S

Vanguard High Yield Tax Exempt Fund Summary Prospectus Investor

Vanguard Tax Exempt Etf Nysearca Vteb For Investors Wanting Quality Without Leverage Seeking Alpha

Vanguard Mutual Fund Investors 2015 Form 1099 Div Instructions Pdf Free Download

How To Invest In Bonds White Coat Investor

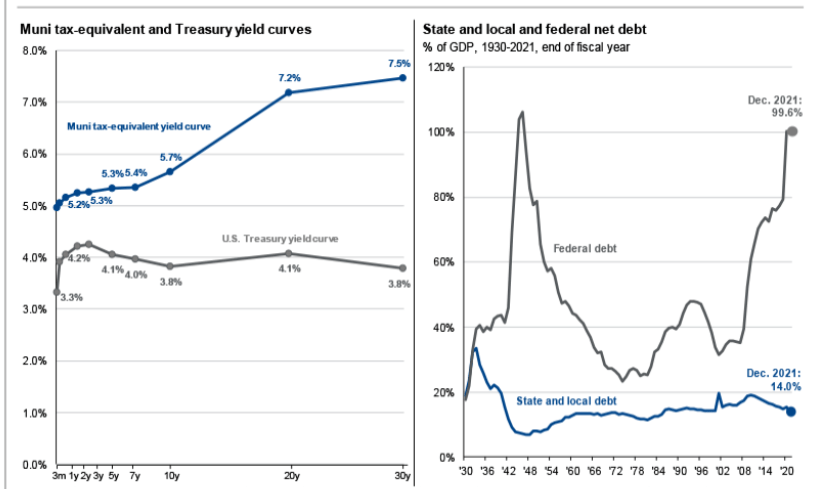

For Debt Stability And Tax Exemption Consider Muni Bond Etfs

Yield Split Method Of Asset Location To Reduce Tax Drag

When Is Tax Loss Harvesting Worth It How To Mistakes And Benefits

Vwitx Vanguard Intermediate Term Tax Exempt Fund Investor Shares Ownership In Us6499055e20 New York State Dormitory Authority 13f 13d 13g Filings Fintel Io

Social Spending Provisions Won T Halt Municipal Bonds

Municipalbond Final Htm Generated By Sec Publisher For Sec Filing

Should You Own A Muni Fund Morningstar

Here S How And Why To Invest In Iowa Municipal Bonds

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Vwahx 41 Years Of High Yield Municipal Income For Retirement Mutf Vwahx Seeking Alpha

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire